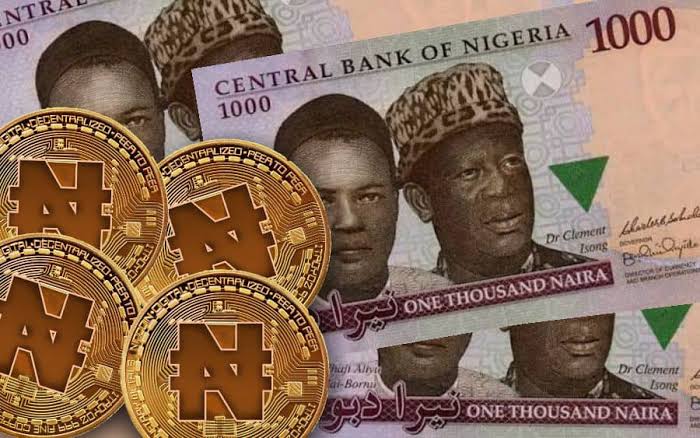

CBN Launches Digital Currency Platform, Over One Million People Register In 24 Hours

The main website of the impending Central Bank of Nigeria (CBN) digital currency, eNaira, went live ahead of its formal introduction on October 1, 2021.

In less than 24 hours, the website has received over one million hits.

The development reveals a reflection of the level of interest in the proposed digital currency.

The website promises easier financial transactions for users of eNaira, offers opportunity for peer-to-peer payments which enables users to transfer money to one another through a linked bank account or card; enables customers to move money from their bank account to their eNaira wallet without stress; it can also monitor their eNaira wallet, check balances and view transaction history; and make in-store payment using their eNaira wallet by scanning QR codes.

Also, users can begin by scanning the QR Code on the website,making it a easy registration procedure.

Mr. Godwin Emefiele, the Governor of the Central Bank of Nigeria, recently told a gathering of foreign investors in New York that as a result to activities surrounding the country’s Independence Day celebrations on October 1, the initial scheduled launch of the eNaira on the same date would possibly be shifted to October 4, 2021.

According to him, “The central bank would not want the event to detract from the celebration of the country’s independence”.

“We will be the first African country to create a digital money. It is a revolutionary notion because we believe it will facilitate trade. With Nigeria as Africa’s largest economy, this will set the tone for Africa to know that we are ready to lead and that we will actually lead in trade.

“We are already working on certain coordination with the central bankers in ECOWAS to make trade, payment, and banking systems integrate in such a way to set an example on the African Continental Free Trade Area (AfCFTA)”.

In accordance with worldwide trends, the CBN recently announced its formal engagement of global fintech business Bitt Inc. as its technical partner for the project, paving the way for the debut of its digital currency.

Emefiele expressed confidence that the eNaira would boost cross-border trade, improve financial inclusion, and result in cheaper and faster remittances. He further said that digital money will make it easier to target social interventions, and also improve the effectiveness of monetary policy, the efficiency of payment networks, and tax collection.

According to the CBN boss, Nigerians should be able to download the eNaira app from either the Google Play Store or the Apple App Store after its launch, log in, and fund their eNaira wallet using their bank account or cash at a registered agent location.

“If you are a bank customer with N10 million in your account, you can tell the bank to load N2 million from your N10 million onto your wallet for your convenience in spending and making purchases. As a result, your physical cash balance reduces to N8 million, but your e-wallet balance rises to N2 million. You can use it to make purchases both locally and across the country.

“The eNaira comes in a variety of forms. But this is where we’d start since we’re not going to pretend that opening up your system is without risk. We’d look at the various items, assess the risk, and identify the best method to limit the risk before expanding it,” Emefiele stated.